lindseymccollu

About lindseymccollu

Transferring Your IRA to Gold: A Complete Information to Diversification And Security

In recent times, the financial panorama has seen a big shift as traders seek to diversify their portfolios and protect their wealth in opposition to market volatility. One of the vital compelling choices that has emerged is the power to switch an individual Retirement Account (IRA) into gold. If you liked this short article and you would like to receive additional info about iragoldinvestments.org kindly take a look at our own website. This text will explore the process, benefits, and concerns of transferring your IRA to gold, providing a comprehensive guide for these fascinated on this funding strategy.

Understanding IRAs and Gold Investments

Earlier than delving into the switch process, it is important to grasp what an IRA is and why gold is taken into account a priceless funding. An IRA is a tax-advantaged retirement account that allows people to save and invest for retirement whereas deferring taxes on the earnings till withdrawal. Traditional IRAs usually hold stocks, bonds, and mutual funds, whereas Roth IRAs enable after-tax contributions with tax-free withdrawals in retirement.

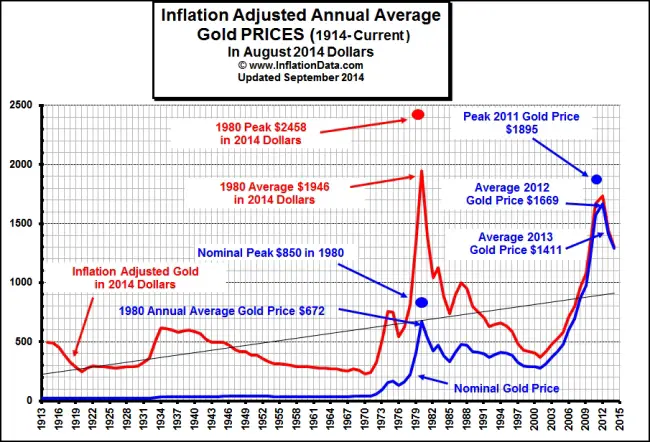

Gold, on the other hand, has been a store of worth for centuries. It is often seen as a hedge in opposition to inflation and economic uncertainty, making it a sexy possibility for traders trying to preserve their wealth. Not like paper property, gold is a tangible asset that can present stability during market downturns, which is why many are contemplating transferring their IRA to gold.

The Process of Transferring Your IRA to Gold

Transferring your IRA to gold includes several steps, and understanding this process is essential for a profitable transition.

- Research and Select a Custodian: The first step is to discover a custodian that focuses on self-directed IRAs, notably people who enable for the investment in valuable metals. Not all IRA custodians supply this service, so it’s essential to do thorough research. Search for custodians with a stable repute, transparent payment buildings, and constructive buyer critiques.

- Open a Self-Directed IRA: Once you have chosen a custodian, you will need to open a self-directed IRA account. This kind of account provides you the flexibleness to put money into a broader vary of property, including gold and different treasured metals.

- Fund Your Account: After opening your self-directed IRA, you possibly can fund it via a switch out of your current IRA or make a direct contribution. If you select to switch funds from one other IRA, guarantee that you comply with the proper procedures to avoid penalties and taxes.

- Choose Your Gold Investments: Along with your self-directed IRA funded, it’s time to decide on the gold products you want to put money into. The IRS has particular laws relating to the kinds of gold that may be held in an IRA. Acceptable types include gold bullion coins (such as the American Gold Eagle), gold bars, and certain gold rounds that meet the minimal purity requirements of .995.

- Buy and Retailer Your Gold: After choosing your gold investments, your custodian will facilitate the purchase of the gold in your behalf. It is crucial to ensure that the gold is stored in an IRS-accepted depository. The IRS requires that each one treasured metals held in an IRA be saved in a secure facility to ensure their security and compliance with laws.

- Maintain Records: All through this course of, it is important to maintain correct data of all transactions, together with purchases, sales, and storage charges. This documentation might be important for tax functions and can assist you to track the efficiency of your gold investments.

Benefits of Transferring Your IRA to Gold

Transferring your IRA to gold provides several advantages that may significantly enhance your investment strategy:

- Safety Against Inflation: Gold has historically maintained its value during inflationary durations. As the cost of living rises, the value of gold typically increases, making it an efficient hedge towards inflation.

- Diversification: Adding gold to your funding portfolio can provide diversification, decreasing general threat. By holding a mixture of assets, you can mitigate the influence of market fluctuations in your retirement financial savings.

- Safety and Stability: Gold is a tangible asset that’s not subject to the same market forces as stocks and bonds. During financial downturns, gold often retains its worth, offering a way of safety for traders.

- Tax Benefits: By transferring your IRA to gold, you can benefit from the tax advantages associated with retirement accounts. Any positive aspects made from the appreciation of gold within the IRA are tax-deferred until withdrawal, permitting your funding to grow with out immediate tax implications.

- Legacy Planning: Gold is usually a valuable asset to pass on to future generations. By holding gold in your IRA, you may ensure that your beloved ones inherit a tangible asset that may preserve wealth over time.

Concerns and Dangers

Whereas there are a lot of benefits to transferring your IRA to gold, there are additionally important considerations and potential risks to remember:

- Market Volatility: Although gold has historically been a stable asset, it isn’t immune to market fluctuations. Costs can be unstable in the quick term, and buyers should be prepared for potential downturns.

- Fees and Prices: Investing in gold through an IRA can involve numerous fees, together with custodian fees, storage fees, and transaction fees. It’s essential to understand these prices and factor them into your investment strategy.

- IRS Laws: The IRS has strict guidelines relating to the kinds of gold that may be held in an IRA, as well as storage necessities. Failure to adjust to these laws may end up in penalties and tax implications.

- Liquidity: While gold is mostly considered a liquid asset, selling gold could be extra complicated than promoting stocks or bonds. Investors should bear in mind of the method and potential challenges when it comes time to liquidate their gold holdings.

Conclusion

Transferring your IRA to gold can be a strategic move for these looking to diversify their investment portfolio and protect their wealth against financial uncertainty. By following the proper steps and working with a good custodian, investors can successfully navigate the process and reap the benefits of gold as a protracted-term investment. As with any investment, it is crucial to conduct thorough research, perceive the risks involved, and seek the advice of with a financial advisor to ensure that this technique aligns along with your total monetary goals. With careful planning and consideration, transferring your IRA to gold may be a strong instrument in securing your monetary future.

No listing found.